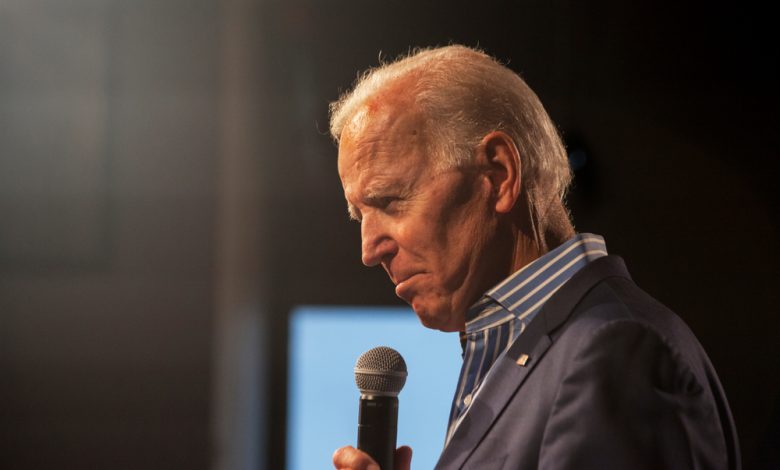

Former Vice President and Democratic presidential nominee Joe Biden’s tax plan will increase rates for many Americans. President Trump says that if it is implemented, the changes would lead to a depression.

Taxes Go Up in Biden’s Plan

“We’ll have – you will see a depression the likes of which you have never seen. You’ll have to go back to 1929, I guess it doesn’t get too much worse than that,” Trump said in an interview with FOX Business last week regarding opponent Biden and running mate Sen. Kamala Harris’ plan for taxes.

Biden’s belief that the wealthy should be taxed more, as well as his goals to make the tax code more progressive and equitable would lead to several loopholes, favoring rich and large corporations, being eliminated.

The changes made to individual income tax rates under the 2017 Tax Cuts and Jobs Act would be repealed by Biden, with the top rate going back to 39.6% over the current 37%, with those with an income over $400,000 being subjected to the 12.4% Social Security tax – split evenly between employees and employers. The current wage cap is $137,700 and wages between the two ranges would not be taxed. Another proposition that Biden has made is capping itemized deductions at 28% of value for the richest Americans.

Corporate tax rates would also go up, with Biden planning to raise it to 28% from the current 21%, which was previously reduced from 35% by the Tax Cuts and Jobs Act. The Democratic nominee has also proposed creating a minimum tax on corporations with at least $100 million in profits, meaning that they would have to pay either a 15% minimum tax or their regular corporate income tax.

Biden’s goal for capital gains is to tax them at the same rate as ordinary income for households earning over $1 million, with the top long-term rate sitting at 23.8%.

The Democrat’s plans would also undo the Tax Cuts and Jobs Act’s change on estate and gift taxes, which doubled the basic exclusion amount to $11.58 million this year, with any and all assets above that amount being subject to a 40% tax rate. Under Biden’s plan, fewer assets could be transferred without triggering the tax.

The former Vice President is also calling for the Child and Dependent Care Tax Credit expansion, which would provide a fully refundable, advance-able tax credit.

Biden’s policies would increase federal revenue by $4 trillion between 2021 and 2030, the Tax Policy Center estimated, although that rise will come at the cost of 1.5% of the GDP, as well as reduce wages by 0.98% and eliminate roughly 585,000 jobs.

Leave a Reply

Thank you for your response.

Please verify that you are not a robot.